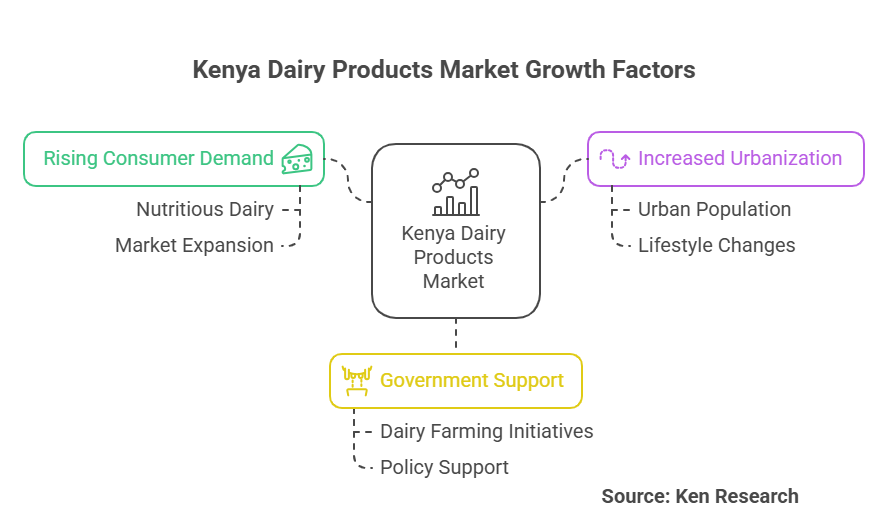

Kenya Dairy Products Market is valued at USD xx billion, driven by rising consumer demand for nutritious dairy, increased urbanization, and government support for dairy farming initiatives. These factors collectively fuel robust market growth and expansion.

Explore emerging trends, innovative product launches, and strategic shifts reshaping the Kenya Dairy Products Market landscape. For in-depth insights and reliable data, visit Ken Research today.

Key Trends Driving Growth in Kenya Dairy Products Market

Explore innovation, market expansion, and strategic shifts shaping Kenya’s dairy sector’s robust growth trajectory.

Rising Demand for Value-Added Dairy Products

Kenya’s dairy market has witnessed a 25% increase in value-added product sales over the past three years, driven by urban consumers seeking convenience and nutrition. This trend reflects shifting preferences toward flavored milk, yogurt, and cheese varieties.

- Urbanization rate at 4.3% annually boosts demand for processed dairy products.

- 20% growth in premium dairy segment signals premiumization opportunities.

Technological Advancements in Dairy Processing

Adoption of modern dairy processing technologies has enhanced product quality and shelf life, with over 60% of processors upgrading equipment since 2020. This shift supports scalability and compliance with international standards.

- 50% reduction in spoilage rates reported by upgraded facilities.

- Increased exports by 15% due to improved quality consistency.

Government Initiatives Supporting Dairy Sector Growth

Government programs such as the Dairy Industry Act and subsidies have driven a 30% boost in milk production and infrastructure development, fostering sustainable dairy farming and market expansion.

- Ksh 3 billion investment in cold chain infrastructure enhances distribution.

- Training for 10,000 farmers improves productivity and product quality.

Increasing Focus on Sustainable and Organic Dairy Farming

Consumer preference for organic and sustainably sourced dairy has led to a 40% rise in organic dairy product availability. Producers are adopting eco-friendly practices to meet demand and reduce environmental impact.

- 25% lower carbon footprint reported by certified organic farms.

- Growing export potential in European markets valuing sustainability.

Stay ahead in this dynamic sector by accessing the comprehensive Global Dairy Products Market Trends report for detailed analysis and strategic insights.

Major Players in the Kenya Dairy Products Market

This section highlights leading dairy companies in Kenya, detailing their market shares, strategic focus areas, and recent innovations shaping the competitive landscape.

Brookside Dairy

- Market Share: 40%

- Key Focus: Sustainable farming, cold chain logistics, product diversification

- Recent Developments: Launched solar-powered chilling centers improving milk preservation and supply efficiency

New Kenya Cooperative Creameries (New KCC)

- Market Share: 25%

- Key Focus: Cooperative farming, quality control, rural dairy empowerment

- Recent Developments: Expanded processing capacity through public-private partnerships enhancing product range

Kenya Dairy Products Market Major Players

Githunguri Dairy Farmers Cooperative Society

- Market Share: 15%

- Key Focus: Organic dairy, community engagement, technology integration

- Recent Developments: Implemented IoT-based milk quality monitoring systems enhancing product consistency

Fanmilk Kenya

- Market Share: 10%

- Key Focus: Frozen dairy products, cold chain innovation, consumer health

- Recent Developments: Introduced biodegradable packaging reducing environmental footprint

Sameer Agriculture & Livestock Limited

- Market Share: 5%

- Key Focus: Livestock genetics, feed quality, supply chain optimization

- Recent Developments: Adopted AI-driven herd management tools improving milk yield and farm profitability

Future Outlook for the Kenya Dairy Products Market

The Kenya dairy products market is projected to reach USD xx billion by 2030, growing at a xx% CAGR, driven by rising urbanization, increased dairy consumption, and government support.

- Growing middle class fueling demand for processed dairy products

- Technological advancements improving production efficiency

- Government initiatives promoting dairy farming and exports

- Rising health awareness boosting consumption of nutritious dairy

Stay ahead in the booming Kenya dairy market by leveraging insights from Ken Research. Act now to capitalize on emerging opportunities and maximize your growth potential.

Conclusion What’s Next for the Kenya Dairy Products Market

The Kenya dairy products market is poised for steady growth driven by rising demand for value-added products, increased investment in cold chain infrastructure, and expanding urban consumption. Stakeholders including producers, investors, and policymakers should monitor evolving consumer preferences and regulatory developments to capitalize on emerging opportunities.

People Also Ask

What is the market size of the Kenya Dairy Products Market

The Kenya dairy products market was valued at USD xx billion in 2023 with an expected CAGR of around xx% through 2028, reflecting strong domestic consumption and export potential.

What are the key trends in the Kenya Dairy Products Market

Key trends include growth in packaged and flavored dairy products, adoption of modern processing technologies, and increased focus on quality standards and cold chain logistics.

Who are the major players in the Kenya Dairy Products Market

Major players include Brookside Dairy, New KCC, Githunguri Dairy, and Sameer Agriculture, which dominate processing, distribution, and retail segments in Kenya.