Executive Summary Taxation Legal Services Market :

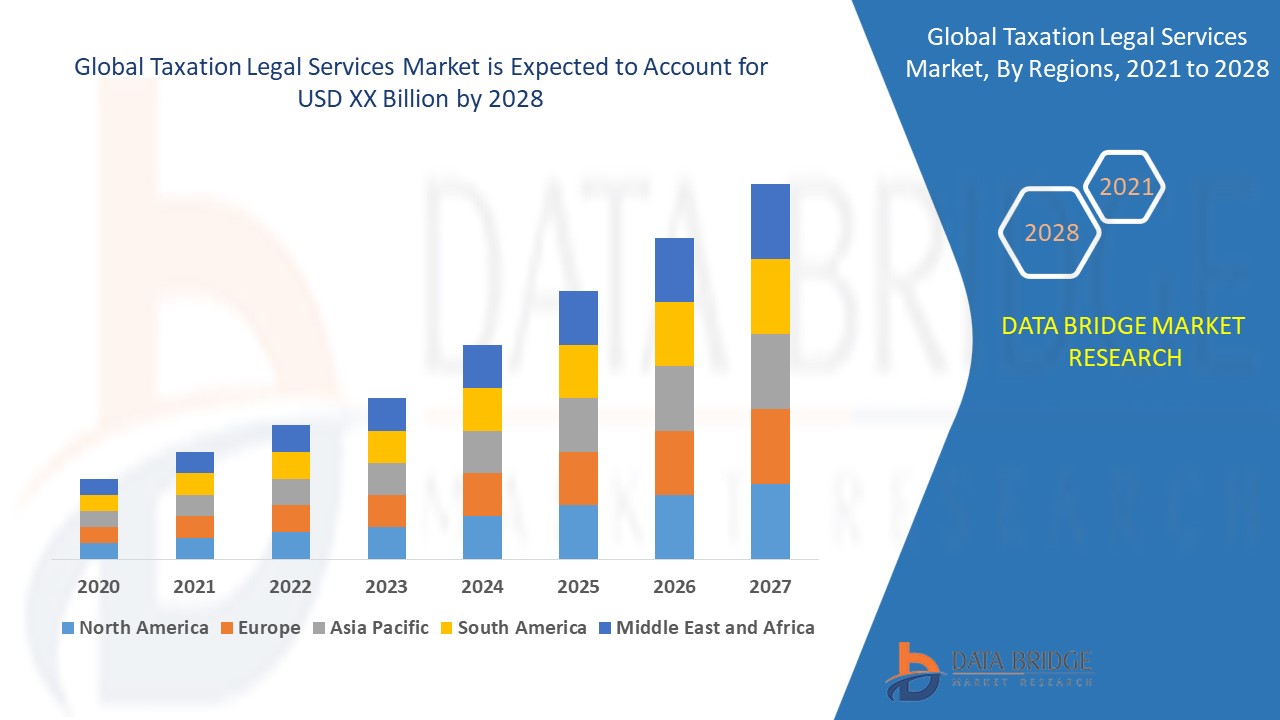

In the forecast period from 2021 to 2028, the taxation legal services market is projected to experience market growth of 4.10%. The taxation legal services market report offers analyses and insights into the numerous factors anticipated to be prevalent during the forecast period while providing their influence on the growth of the market.

Trustworthy sources such as websites, journals, mergers, newspapers and other authentic sources have been referred to collect all the stats, data, facts and figures required to structure this Taxation Legal Services Market report. It is a comprehensive and proficient report that focuses on primary and secondary market drivers, market share, leading segments and geographical analysis. The market share of major competitors on global level is studied where key areas such as Europe, North America, Asia Pacific and South America are taken into account in this market research report. Taxation Legal Services Market business document also provides better market insights with which business can be driven into right direction.

Additionally, Taxation Legal Services Market report explains better market perspective in terms of product trends, marketing strategy, future products, new geographical markets, future events, sales strategies, customer actions or behaviours. The report brings into focus studies about market definition, market segmentation, and competitive analysis in the market. As per the DBMR team predictions cited in this report, the market will grow with a specific CAGR value in the forecast period. This Taxation Legal Services Market report also covers very important aspect which is competitive intelligence and with this businesses can gain competitive advantage to thrive in the market. Various parameters covered in this research report helps businesses for better decision making.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Taxation Legal Services Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-taxation-legal-services-market

Taxation Legal Services Market Overview

**Segments**

- **Service Type:** The global taxation legal services market can be categorized based on the type of services offered, such as tax planning, compliance, litigation, and advisory services. Tax planning services involve helping businesses and individuals develop strategies to minimize tax liabilities legally. Compliance services ensure that organizations adhere to tax laws and regulations. Litigation services involve representing clients in tax-related disputes or audits. Advisory services provide expert advice on complex tax matters.

- **End-User:** The market can also be segmented by end-users, including individuals and businesses of varying sizes across sectors such as financial services, healthcare, manufacturing, IT, and others. Different end-users have unique tax requirements and challenges, which drive the demand for specialized taxation legal services.

- **Region:** Geographically, the global taxation legal services market can be segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. Each region has its own tax laws and regulations, influencing the demand for legal services tailored to specific local requirements.

**Market Players**

- **Deloitte Touche Tohmatsu Limited:** Deloitte is a global leader in tax services, offering a wide range of taxation legal services to clients worldwide. The company's expertise spans tax planning, compliance, litigation support, and advisory services, catering to diverse industry sectors.

- **PricewaterhouseCoopers (PwC):** PwC is another prominent player in the global taxation legal services market, known for its comprehensive tax solutions for businesses and individuals. The firm's services include tax strategy development, compliance management, and litigation representation, helping clients navigate complex tax landscapes effectively.

- **EY (Ernst & Young):** EY is a trusted provider of taxation legal services, delivering tailored solutions to address clients' tax challenges and opportunities. The company's tax professionals offer strategic advice, compliance support, and advocacy services to help clients achieve their financial goals while staying compliant with tax laws.

- **KPMG International:** KPMG is a leading provider of tax and legal services globally, assisting clients with tax planning, risk management, and compliance issues. The firm's dedicated tax professionals help organizations optimize their tax positions and mitigate tax-related risks effectively.

- **Baker McKenzie:** Baker McKenzie is a renowned law firm offering comprehensive taxation legal services to clients worldwide. The firm's tax lawyers provide strategic advice, dispute resolution, and transactional support to address complex tax issues across borders and industries effectively.

The global taxation legal services market is highly competitive, with these key market players dominating the industry by offering a wide range of services to meet diverse client needs. As tax regulations continue to evolve, the demand for specialized legal services to navigate complex tax environments is expected to rise, driving the growth of the global taxation legal services market in the coming years.

The global taxation legal services market is witnessing significant growth due to the increasing complexity of tax laws and regulations worldwide. As businesses and individuals strive to navigate through the intricate tax landscapes, the demand for specialized taxation legal services is on the rise. Market players such as Deloitte Touche Tohmatsu Limited, PricewaterhouseCoopers (PwC), EY (Ernst & Young), KPMG International, and Baker McKenzie are leading the industry by providing a diverse range of services tailored to meet the unique needs of clients across various sectors and geographies.

One of the emerging trends in the global taxation legal services market is the emphasis on technology and automation to enhance efficiency and accuracy in tax compliance and planning processes. Market players are increasingly leveraging advanced technologies such as artificial intelligence and machine learning to streamline tax operations, improve data analytics, and provide more precise tax advice to clients. This technological integration not only boosts the overall service quality but also helps in reducing the margin of error in tax-related activities.

Another significant trend shaping the market is the increasing focus on sustainability and social responsibility in tax practices. With growing awareness about environmental and social issues, businesses are under pressure to adopt ethical and compliant tax practices that align with sustainable development goals. Market players are responding to this trend by incorporating sustainability criteria into their tax planning and compliance services, thereby helping clients achieve their financial objectives while contributing to societal welfare.

Moreover, the evolving regulatory landscape, including the implementation of new tax laws and compliance requirements, is driving the demand for specialized taxation legal services. Market players need to stay abreast of these regulatory changes and adapt their service offerings to ensure clients remain compliant and competitive in the evolving tax environment. This dynamic regulatory environment presents both challenges and opportunities for market players to differentiate themselves by providing innovative and customized solutions to clients.

Additionally, the market is witnessing a shift towards tailored and industry-specific tax services to meet the unique needs of different sectors. With businesses operating in diverse industries facing specific tax challenges, there is a growing demand for expertise in niche areas such as financial services, healthcare, manufacturing, and technology. Market players that can offer specialized tax services aligned with industry requirements are likely to gain a competitive edge and tap into new market opportunities.

In conclusion, the global taxation legal services market is on a growth trajectory driven by factors such as technological advancements, sustainability focus, regulatory changes, and industry specialization. Market players need to continuously innovate and adapt to meet the evolving needs of clients in an increasingly complex tax landscape. By leveraging technology, embracing sustainability practices, and providing tailored industry solutions, market players can position themselves for success in a competitive market environment.The global taxation legal services market is undergoing significant transformations driven by several key trends that are shaping the industry landscape. One notable trend is the increasing emphasis on technology and automation within tax compliance and planning processes. Market players are integrating advanced technologies like artificial intelligence and machine learning to enhance the efficiency and accuracy of tax operations. This technological integration not only improves service quality but also minimizes errors, enabling firms to provide more precise tax advice to clients. As technology continues to advance, the reliance on automation in tax services is expected to grow, further optimizing operational processes and enhancing client satisfaction.

Another crucial trend impacting the market is the rising focus on sustainability and social responsibility in tax practices. Businesses are increasingly pressured to adopt ethical and compliant tax strategies that align with sustainable development goals and societal welfare. Market players are responding by incorporating sustainability criteria into their tax planning and compliance services, helping clients achieve financial objectives while adhering to ethical tax practices. This shift towards responsible tax practices reflects a broader societal trend towards environmental and social consciousness, influencing how businesses approach tax compliance and planning.

Furthermore, the evolving regulatory landscape, characterized by the introduction of new tax laws and compliance requirements, is driving the need for specialized taxation legal services. Market players must stay informed about regulatory changes and adapt their service offerings to ensure clients remain compliant and competitive amidst evolving tax environments. The dynamic nature of regulations presents both challenges and opportunities for firms to differentiate themselves by providing innovative solutions tailored to meet client needs effectively. By staying ahead of regulatory changes and offering customized services, market players can navigate the complex tax landscape successfully and stand out in a competitive market environment.

Additionally, there is a noticeable trend towards industry-specific tax services tailored to meet the unique requirements of different sectors. As businesses in diverse industries face specific tax challenges, there is a growing demand for specialized expertise in areas such as financial services, healthcare, manufacturing, and technology. Market players that can offer industry-specific tax services aligned with sector requirements have the opportunity to differentiate themselves and capitalize on emerging market prospects. By providing tailored solutions to address the distinct tax needs of various industries, firms can enhance their market position and cater to evolving client demands effectively.

In conclusion, the global taxation legal services market is experiencing significant shifts propelled by trends such as technology integration, sustainability focus, regulatory changes, and industry specialization. Market players need to adapt to these trends by leveraging technological advancements, embracing sustainable tax practices, staying updated on regulatory developments, and offering industry-specific solutions to meet client expectations effectively. Embracing these trends will not only enable firms to navigate the complexities of the global tax landscape but also position them for growth and success in a competitive market environment.

The Taxation Legal Services Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-taxation-legal-services-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Answers That the Report Acknowledges:

- Taxation Legal Services Market size and growth rate during forecast period

- Key factors driving the Taxation Legal Services Market

- Key market trends cracking up the growth of the Taxation Legal Services Market.

- Challenges to Taxation Legal Services Market growth

- Key vendors of Taxation Legal Services Market

- Opportunities and threats faces by the existing vendors in Global Taxation Legal Services Market

- Trending factors influencing the market in the geographical regions

- Strategic initiatives focusing the leading vendors

- PEST analysis of the Taxation Legal Services Market in the five major regions

Browse More Reports:

Global Optometry/Eye Exam Equipment Market

Global Low Temperature Powder Coatings Market

Potato Chips Market

Europe Minimally Invasive Surgical Instruments Market

Global Marfan Syndrome Treatment Market

Global Polystyrene Market

Global Cheese Substitute Market

Global Catalyst Handling Services Market

Asia-Pacific Enterprise File Synchronization and Sharing Market

Global Radiological Diagnostics Market

Global Connected Packaging Market

Middle East and Africa Ophthalmology Devices Market

Global Silent Thyroiditis Market

Global 5G Substrate Materials Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com