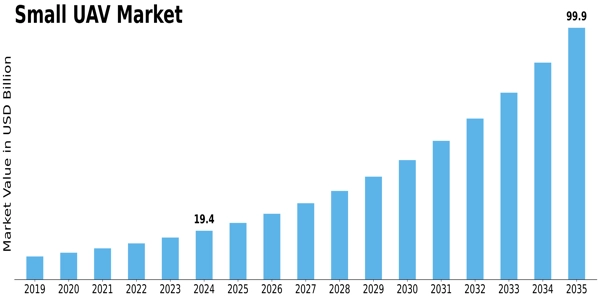

In the rapidly evolving world of aviation technology, the small unmanned aerial vehicles (UAVs) sector is asserting itself as a major growth engine. According to recent research by MRFR, the global small UAV market was valued at approximately USD 19.45 billion in 2024 and is projected to surge to around USD 100.11 billion by 2035 — a compounded annual growth rate (CAGR) of roughly 16.06% between 2025 and 2035.

Market Outlook

Such robust growth reflects the escalating demand for compact UAVs across commercial, civilian and defense domains. Key drivers include advances in battery and sensor technology, the democratization of aerial imagery, and burgeoning use in precision agriculture, logistics, and security surveillance. However, obstacles persist — regulatory frameworks, air-traffic management and security/privacy concerns will require further maturation.

Industry Overview

The small UAV niche covers platforms categorized largely as micro and mini types, contrasting with larger drone or unmanned systems. These smaller platforms excel in flexibility, lower cost, and applications where manoeuvrability is critical — for example, crop surveying, building inspections or tactical reconnaissance. With the opening of airspace to commercial drone operations and the convergence of autonomous navigation, the industry is transitioning from novelty to operational necessity.

Key Players

Several global players are shaping the competitive landscape: Lockheed Martin (USA), BAE Systems (UK), AeroVironment Inc. (USA), DJI (China), Elbit Systems Ltd. (Israel), SAAB (Sweden) and others are investing heavily in R&D, strategic partnerships and expanded manufacturing to stay ahead in this dynamic market.

Segmentation Growth

From a type‐perspective, micro‐UAVs dominated the market in 2022, accounting for roughly 70% of revenue — owing to their suitability in hazardous or hard-to-reach areas. By application, the commercial/civil sector generated approximately 65% of 2022 revenue, reflecting strong interest in surveying, mapping, inspection and precision agriculture. In terms of platform, rotary‐wing systems led with about 59% revenue share in 2022, thanks to their hovering ability and ease of deployment. Regionally, North America remains the dominant geolocation, followed by Europe and a fast-growing Asia-Pacific region (especially China and India) thanks to both defense budgets and commercial adoption.

Conclusion

For stakeholders across aerospace, agriculture, logistics and infrastructure inspection, the small UAV market value offers compelling opportunity. To capitalise, companies must stay agile — embracing technological innovation, navigating regulatory environments, and partnering to create scalable solutions. With the sector scheduled to more than quintuple over the next decade, those who position themselves now may well lead in the skies of tomorrow.

Related Report:

Commercial Aircraft Propeller Systems Market